Student Aid BC is Canadian Government (provincial and federal) student loans and grants. Canadian Flight Centre is approved for student loan financing.

Note, that not every pilot training program is eligible for Student Aid BC. For example, Student Aid BC, at this time, does not finance any recreational type of training, incl. Private Pilot License or any portion thereof.

Additional conditions must be satisfied by the applicant. The information below is given as a reference only and may change without notice. For exact current numbers and regulations, please consult StudentAidBC.

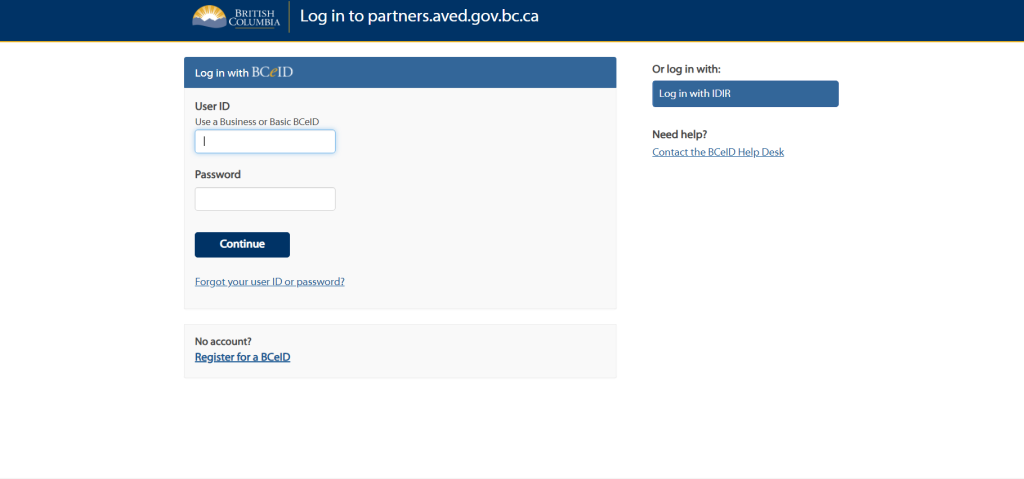

Application for Student Loans, both provincial and federal shall be made through the Student Financial Aid Partner Portal. You must be a full-time Canadian Flight Centre student on one of our approved Programs. See Attendance Policies for details of full-time studies (min 15 hours per week). Student Loans BC has some limited provisions for part-time studies.

To learn more about StudentAidBC’s terms and policies, visit StudentAidBC website: https://studentaidbc.ca

CFC Programs currently eligible for student loans include:

Note, that this list is subject to annual revision and may change any time without notice.

Contact us for further details and registration: students@cfc.aero

2020-2021 Information for reference

Grants. under certain circumstances, a portion of the student loan does not need to by paid back, aka grant.